Home » Africa E-Mobility Report 2025

Africa is accelerating its transition to electric mobility in Africa, driven by global shifts like ICE vehicle bans by 2035 in major economies such as the EU, UK, Canada, US (California and 17 states), China, and South Korea. With over 30,000 active EVs as of May 2025, e-mobility Africa 2025 highlights unique opportunities in circularity for battery reuse and gender inclusion to boost women’s participation. This concise fact sheet, updated every 3-6 months by the Africa E-Mobility Alliance (AfEMA), provides the continent’s only comprehensive summary of EV growth, policies, investments, and emerging trends in electric vehicles Africa.

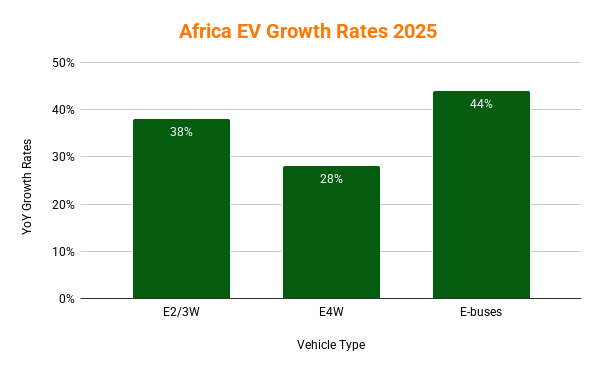

Africa’s EV fleet has seen impressive expansion, totaling at least 30,000 vehicles. Key growth rates underscore the momentum in e-mobility Africa 2025: Electric 2- and 3-wheelers (E2/3W) grew 38% year-over-year (YoY), electric 4-wheelers (E4W) increased 28% YoY, and e-buses surged 44% YoY. This rapid adoption is fueled by commercial applications, where Africa’s low motorization rate (43 vehicles per 1,000 people vs. global 197) and high public transport reliance (60-80% of urban trips) make EVs ideal.

Regional distribution reveals East Africa’s dominance in E2/3W, with Tanzania leading with an estimated 10,000 (most of which are lead-acid scooters), followed by Kenya (8,421), Togo (4,000), and Uganda (3,200). For e-buses, Egypt tops with 200 units, Senegal has 155, and Kenya 54. Light-duty vehicles (LDVs) are strongest in South Africa (1,559), Egypt (380), and Kenya (326). These figures emphasize uneven but promising penetration across the continent.

Key Takeaway: Commercial E2W leads adoption due to strong product-market fit and financing, positioning Africa for scalable e-mobility growth amid global EV shifts.

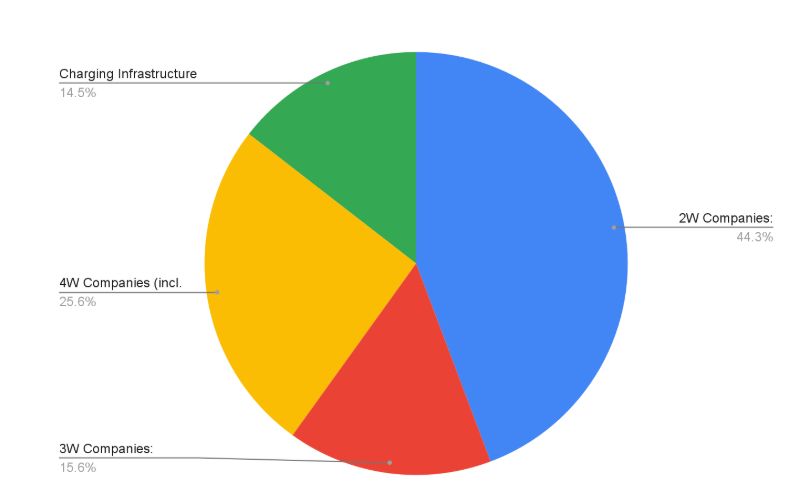

The e-mobility ecosystem in Africa boasts 208 active companies, with East Africa hosting 98, Southern Africa 46, West Africa 39, North Africa 19, and Central Africa 6. This distribution reflects vibrant markets in Kenya, Rwanda, Uganda, and South Africa, focusing on electric motorcycles, charging solutions, and public transport.

Market trends show commercial uptake far outpacing private ownership, with up to 80% of urban trips via shared taxis or moto-taxis like boda bodas in Kenya (contributing USD 4.4 billion annually) or okadas in Nigeria. Notable deployments include BasiGo’s 100 e-buses serving thousands daily in Kenya and Moove’s EV ride-hailing fleets in Nigeria, South Africa, and Ghana. E3W lags due to limited models and infrastructure, while e-buses rely on local assembly of Chinese brands.

Key Takeaway: Africa’s EV market trends prioritize high-utilization commercial segments, creating pathways for e-mobility startups Africa to capture the continent’s massive ICE motorcycle fleet turnover every 5-10 years.

EVs offer significant cost savings over ICE vehicles, making them economically viable for Africa’s transport needs. In Kenya, driving 100km in an EV costs 47-83% less: light-duty (USD 0.62-0.92 vs. USD 6.62), medium-duty (USD 2.40-3.58 vs. USD 15.22), and heavy-duty buses (USD 19.14-28.50 vs. USD 61.07).

Electric bus prices vary: Locally assembled mini/mid-size in Kenya (USD 55,000-60,000), Uganda’s Kiira (USD 58,800-90,000), vs. imports like BYD in South Africa (USD 250,000-300,000) or Senegal’s BRT (USD 300,000+).

Investments exceed USD 100 million per region (except Central Africa), with highlights like BasiGo’s USD 42 million for 1,000 buses in Kenya/Rwanda and Uganda’s USD 160 million (2018-2024), projecting USD 800 million more. Scaling E2W requires USD 3.5-8.9 billion in financing, supported by early-stage grants (e.g., AfDB’s Green Mobility Facility for Africa in seven countries) and growth debt (e.g., Ampersand and Roam).

Key Takeaway: Lower operating costs drive EV policies Africa adoption, but bridging early-to-late-stage funding is essential for rapid scaling in e-mobility investments Africa.

Africa’s e-mobility policies are evolving, with 13 countries (e.g., Kenya, Rwanda, Ethiopia) publishing national strategies, though implementation varies. East Africa: Ethiopia’s 2024 ICE import ban (world first), Rwanda’s 2025 ICE motorcycle ban in Kigali, Kenya’s VAT exemptions on e-motorcycles/buses. Southern Africa: South Africa’s 150% tax deduction for EV production (2026), Malawi’s E2W duty waivers. West Africa: Ghana’s exemptions and bus assembly pilots, Nigeria’s 2023 National EV Policy. North Africa: Morocco’s USD 15 billion in EV/battery investments, Egypt’s 20,000 EVs by 2030 target.

Import incentives include Rwanda’s 0% duties on EVs, Ethiopia’s duty-free CKD kits (5% SKD, 15% FBU), and Nigeria’s 10-year tax holidays. Supply-side regulations like Kenya’s <80% battery health import ban ensure quality.

Key Takeaway: Fiscal incentives focus on commercial vehicles for immediate impact, but uneven regulations (e.g., Uganda’s 25% duty reversal) challenge consistent EV policies Africa growth.

Gender inclusion remains low (<20% workforce female), but initiatives are advancing: Rwanda’s Ampersand training women e-moto drivers, Kenya’s Roam Women in EV Program, South Africa’s BAIC-SA 30% female target, Uganda’s Zembo solar kiosks for women, Nigeria’s MAX.ng women-only networks. Regional efforts like Afri-EV Women’s Alliance advocate for quotas.

Circularity embeds reuse, with Kenya’s Drivelectric/WEEE Centre repurposing batteries for solar storage, alongside Rwanda’s SLS Energy, Nigeria’s Thinkbikes, Ghana’s E-Waste Ghana, and South Africa’s REVOV. Challenges include limited recycling; policies should prioritize collection and second-life applications.

Key Takeaway: Addressing gender and circularity unlocks sustainable e-mobility Africa 2025, fostering equity and environmental benefits.

With YoY growth outpacing many regions, Africa’s electric mobility in Africa is set for expansion through targeted investments and policies. Stay updated—next refresh Q4 2025.

Keep abreast of the latest developments in the emobility sector.

Receive our most important updates by email and stay up to date with the newest transformations on sustainable mobility around the world.